Put Options: The basis of the insurance industry.

How to profit from buying or selling insurance on publicly traded stocks

Hey there Maverick!

A client of mine is an investment banker who took me under his wing and tutored me in various aspects of finance. He would set me homework tasks to do on my one day for the week when I was a 27 yr old running my first business and didn’t care how tired I was, if I wanted to learn this was the price to pay.

One day, I remember him posing this question to me “Ben, who runs the world?”

I had no serious idea.

After stumbling like an idea putting forth various suggestions like; governments, central banks, the mafia etc he put an end to my misery with the following answer

“Insurance companies”

He then went into a long and brilliant dissertation as to how all state funding, private institutions and many capital flows are determined by actuarial calculations/assumptions.

I won’t bore you with the details and I have no idea whether or not you agree, but one thing stuck in my mind “I wonder if there’s a way I can harness the power and leverage of an insurance business model, albeit on a smaller scale?”

I’d read that Warren Buffet was a huge fan of insurance-style businesses as investments. This is mainly due to the statistical advantage they hold of profiting through the sale of premium as well as the ability to earn interest payments on ideal cash that people just give you every month (the float, or said premium that sits in an account waiting to pay out claims).

As time past I discovered that insurance contracts were traded in huge volume over publicly traded stocks. These contracts were called options and even a small-time entrepreneur like myself could make money from them.

And so in today’s (long) article, I start you off on the most fundamental of insurance contracts, the put option. This is a key piece of my running a one-man insurance company.

Now, let's delve into the world of put options and discover which strategy suits your investment goals. Let's dive in!

Understanding Put Options:

Put options are powerful financial derivatives that grant the holder the right, but not the obligation, to sell an underlying asset at a predetermined price within a specific timeframe. They act as insurance against potential declines in asset value.

Buying Put Options:

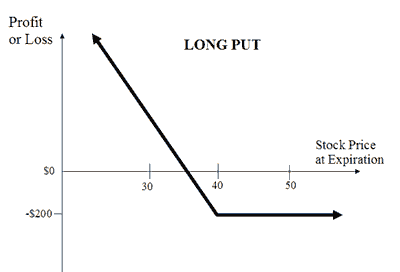

Mechanics: When you buy put options, you pay a premium to acquire the right to sell the underlying asset at the strike price. If the asset's price stays above the strike price, the put option expires worthless, resulting in a limited loss equal to the premium paid.

Profit Potential: Buying put options can be profitable when the price of the underlying asset drops below the strike price. Let's consider an example:

Company XYZ Stock

Suppose you have been closely monitoring the stock of Company XYZ, which is currently trading at $100 per share. Based on your analysis and market indicators, you anticipate a potential market downturn that could impact the stock's value. To protect your portfolio and potentially profit from this decline, you decide to buy put options.

Option Selection: You select a put option contract for Company XYZ with a strike price of $95 and an expiration date one month from the current date. The premium for the put option is $3 per share, and each contract represents 100 shares. To purchase one contract, you would pay a total premium of $300.

Market Downturn: As predicted, Company XYZ's stock price experiences a substantial decline over the next few weeks, falling to $80 per share.

Exercising the Put Option: With the stock price below the strike price of $95, you decide to exercise your put option. By doing so, you have the right to now sell the stock at the strike price, even though its market value is lower. You sell the stock at $95 per share, earning a profit of $15 per share (the difference between the strike price and the actual stock price at the time of exercise).

Overall Profit: Considering each put option contract represents 100 shares, your profit per contract would be $1,500 ($15 per share profit multiplied by 100 shares). Deducting the premium paid for the option contract ($300), your net profit from this transaction would be $1,200.

By buying put options, you were the buyer of an insurance policy and when the stock tanked the underwriter (the guy who sold you the insurance) has to pay you out on your ‘claim’ (put option) and ‘make you whole’ by buying the stock at the contracted price, not the market price.

Similar to if you bought fire insurance and your house burned down, the insurer has to pay you the agreed value in the contract, not the (now significantly reduced) market value.

So, how do I make money by being the insurance company?

Selling Put Options:

Mechanics: Selling put options involves acting as the writer of the option contract, receiving a premium from the buyer, and taking on the obligation to purchase the underlying asset if the buyer exercises the option.

Profit Potential: By selling put options, you can profit when the options expire worthless, allowing you to keep the entire premium received. Alternatively, if the asset's price falls significantly, you may think of it as acquiring the asset at a potentially discounted price.

Example: Company ABC Stock

Suppose you have been closely following the stock of Company ABC, which is currently trading at $50 per share. Based on your analysis you believe that the stock has strong long-term potential and is trading at an attractive price. To potentially acquire the stock at a discounted price and/or generate income, you decide to sell put options.

Research: You identify a target price at which you would be comfortable owning the stock.

Option Selection: You select a put option contract for Company ABC with a strike price of $45 and an expiration date one month from the current date. The premium for the put option is $2 per share, and each contract represents 100 shares. By selling one contract, you receive a total premium of $200.

Option Expiration: As the expiration date approaches, the stock price of Company ABC remains above the strike price of $45. This means the put option expires worthless, and you get to keep the entire premium received.

Income Generation: Since the put option expired worthless, you retain the $200 premium received for selling the put option. This represents your profit from the transaction.

Potential Stock Acquisition: In the event that the stock price had fallen below the strike price during the option's lifespan, you would have been obligated to purchase the stock at the strike price of $45 per share. This would have allowed you to acquire the stock at a potentially discounted price, aligning with your long-term investment strategy.

By selling put options, you were able to generate income through the premiums received and potentially acquire the stock at a lower price. This example illustrates how selling put options can provide a strategy for income generation and an opportunity to purchase desired assets at attractive prices.

It's important to note that selling put options involves risks, and the outcome may vary depending on market conditions and individual circumstances. Thorough research, risk management, and careful analysis are crucial when engaging in options trading or any investment activity.

Comparing the Strategies:

Risk Exposure: Buying put options limits potential losses to the premium paid, making it a suitable hedging tool. However, selling put options carries the risk of purchasing the asset at a higher price than its market value if the asset's price falls significantly.

Income Generation: Selling put options provides an opportunity to generate income through premiums received. Conversely, buying put options requires paying a premium, with the potential for profit if the asset's price decreases significantly.

Asset Acquisition: Selling put options allows investors to potentially acquire desired assets at attractive prices if the options are exercised. Buying put options, on the other hand, provides the flexibility to sell assets at favorable prices.

Risks and Considerations:

Both buying and selling put options involve risks such as time decay, implied volatility, and market liquidity. Thorough research, risk management strategies, and market understanding are crucial for successful implementation.

Conclusion:

Put options offer distinct strategies for investors to profit from market downturns and protect their portfolios. Buying put options provides a hedging tool and potential profit when asset prices decline. Selling put options offers income generation and opportunities for acquiring assets at attractive prices.

Remember, options trading involves risks, and it's crucial to conduct thorough research, seek professional advice, and continually educate yourself in the world of investing.

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Always consult with a professional financial advisor before making any investment decisions.